INSIGHTS

Category

- Series A 2

- Series B 1

- Series Seed 2

- acquisition 2

- asset 2

- board 1

- board of directors 1

- business 1

- compliance 1

- corporation 4

- delaware 1

- director 1

- exit 2

- fiduciary duties 2

- financing 2

- fundraise 2

- incorporation 1

- investor 1

- preferred stock 1

- rights 1

- stock 2

- stockholder 3

- term sheet 1

- transaction 2

- venture capital 1

Tax Implications of ISO Exercises: What Startup Founders and Employees Need to Know

How to Pitch to Investors: Five Key Tips for Early-Stage Startup Founders

Securing funding is crucial for early-stage startup founders, and delivering a compelling pitch can make all the difference. In this blog post, we explore five key tips for pitching to investors: make them think with thought-provoking questions, share a personal story to connect on a deeper level, evoke emotions by being raw and vulnerable, present surprising facts to highlight urgency, and maintain honesty by admitting what you don't know. By following these strategies, founders can create a memorable and impactful narrative that resonates with investors and builds lasting relationships.

Milestones Investments in Life Science Startup Fundraising Rounds

Explore the importance of milestones in investment documents for life science startups. Learn how to structure measurable goals that align with business objectives, enhance investor communication, and attract funding opportunities. Understand the significance of clinical, financial, operational, and market entry milestones in preferred stock rounds. Optimize your startup's fundraising strategy with clear, relevant milestones.

The Legal and Tax Ramifications of Failing to File an 83(b) Election: A Guide for Startup Founders

Discover the legal ramifications of not filing an 83(b) election for startup founders. Learn about the tax consequences for stockholders and companies, especially W2 employees, related to restricted stock vesting. Explore options to address missed filings and strategies to structure equity compensation, including the benefits of stock options versus restricted stock grants.

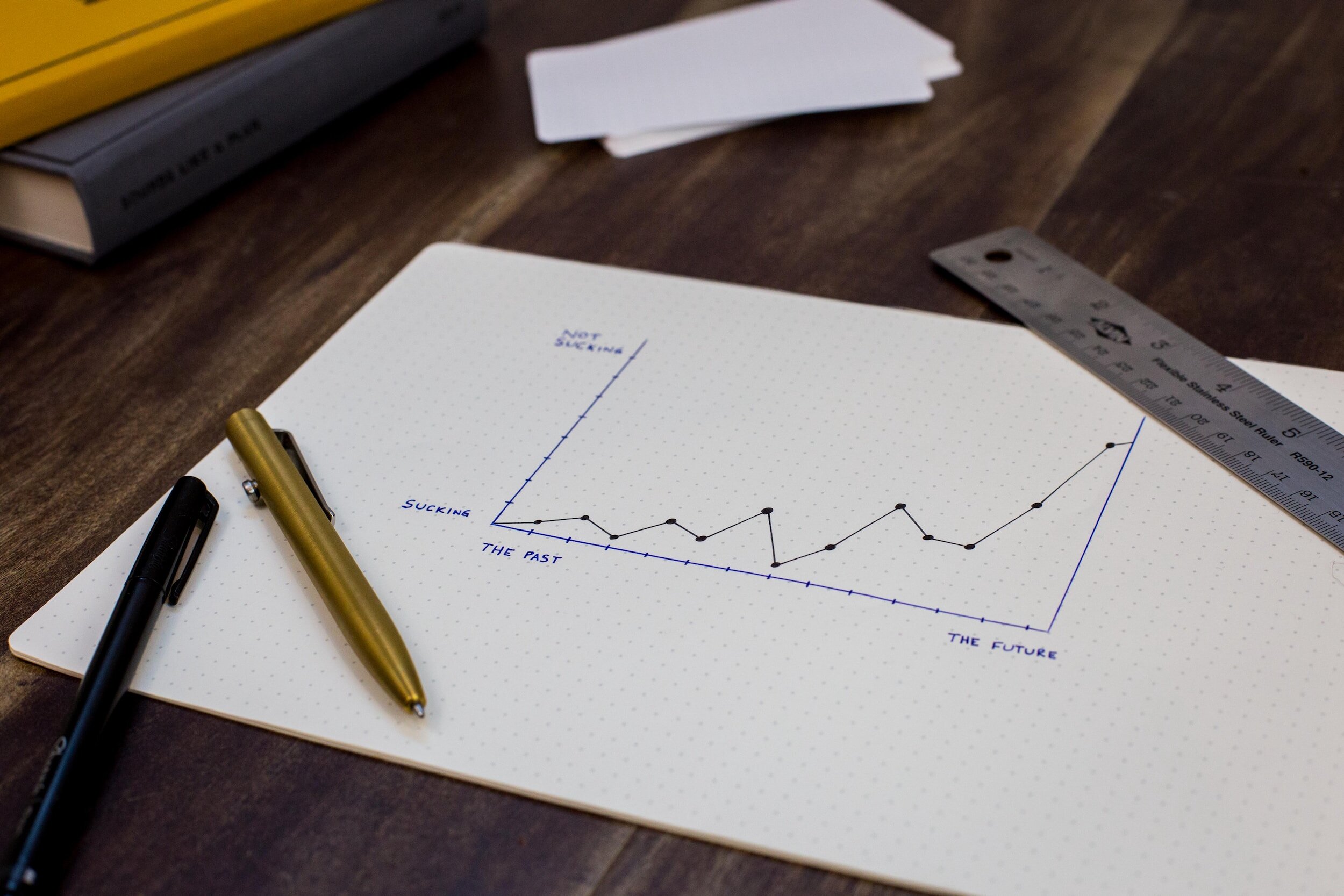

Navigating Fundraising Without Losing Yourself: Maintaining Well-being as a Startup Founder

The startup fundraising process is undoubtedly challenging for founders, but it doesn’t have to come at the expense of your well-being. By remembering that all opinions are subjective, trusting your vision, and prioritizing your mental and physical health, you can navigate the pressures of fundraising without losing yourself.

Federal Trade Commission Bars Employers from Enforcing Non-Compete Agreements

Understand the details and impact of the Federal Trade Commission’s new rule to bar employers from enforcing non-compete agreements

Navigating Section 1244: Tax Relief for Startup Stock Losses

Understand how startup investors and other stockholders can gain some tax relief under Section 1244 of the Internal Revenue Code when a startup losses value.

How (and When) to File Delaware Corporate Franchise Taxes

Don’t overpay Delaware franchise taxes! Use this comprehensive guide to calculate the exact amount of franchise taxes your Delaware corporation owes.

Qualified Small Business Stock for Startups

Qualified Small Business Stock comes with substantial tax incentives—if companies and stockholders satisfy all IRS requirements.

Corporate Transparency Act: Beneficial Ownership Information Filing Requirements

How to comply with the Corporate Transparency FinCen filing requirements.

What is a 409A Valuation?

Understand the key purposes of a 409A valuation for a startup company.

Transitioning to Series B Funding: Key Differences between Series A and Series B Rounds

Understand the expectations, challenges, and considerations of closing a Series B fundraising round.

Key Terms in a Preferred Stock Term Sheet for Startup Founders

We break down the crucial terms of a preferred stock financing term sheet.

The Delaware Advantage: Why Are So Many Companies Incorporated in Delaware?

Learn about the key factors that have contributed to Delaware's status as a corporate haven.

Minority Stockholders' Rights in Delaware Corporations

Explore the rights of minority stockholders in Delaware corporations and how these rights are safeguarded by Delaware corporate law.

Asset Purchases vs. Stock Purchases: Navigating Risks in Company Acquisitions

Explore the different risks and considerations of asset purchase and a stock purchase transactions and best practices for making an informed decision about deal structure.

Fiduciary Duties of Board of Directors in Delaware Corporations

Director fiduciary duties, including the duty of care, duty of loyalty, and duty of good faith, lay the foundation for responsible decision-making and the protection of stakeholders' interests.

Bulk Transfer Laws in Asset Purchase Transactions

Understanding bulk transfer laws and how to comply with them during an asset purchase transaction.